Property finance loan loan modification (dwelling bank loan modification) is where the loan company may possibly decreased your

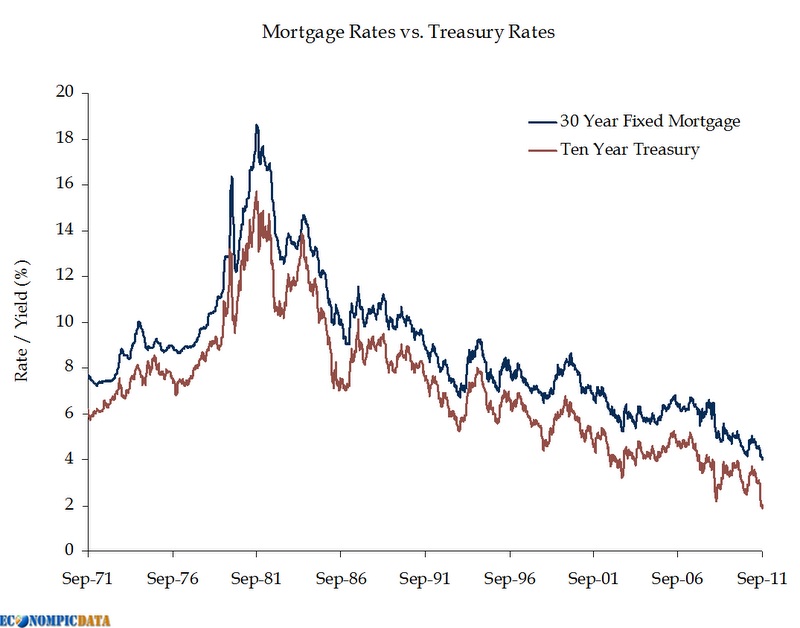

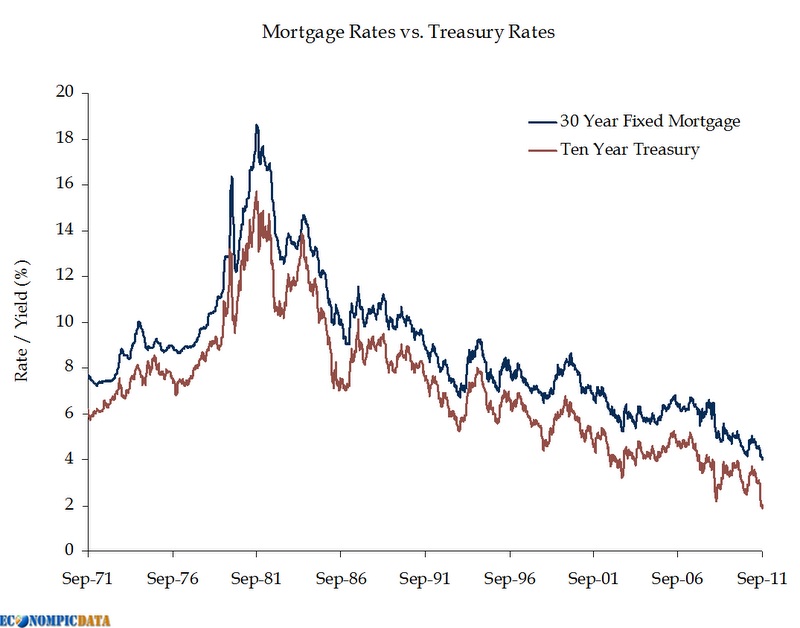

30 yr mortgage rates forecast, or add any dues to the mortgage loan equilibrium and lengthen your bank loan period of time. If you are not contented with the analysis you done then you can consider assist of the specialists that are prepared to present you assistance 24/seven. They also never want to explain to you that when your property finance loan time period ends, you can shop close to - you don't have to adhere with your lender!

All of the facts you deliver will aid your broker acquire the best offset home finance loan obtainable for you on the market. This couldn't be even further from the scenario. The curiosity cost is dependent upon the existing desire premiums and that rate which you secure at the get started of the loan.

Precise data have to be posted by the copywriter regarding expenditure qualities, reverse mortgages and refinancing. You tend to commit the largest oversight in mortgage purposes anytime you focus on the exhilaration of being aware of that you are going to maintain a big amount of income with out considering the intricate responsibilities entailed with it. It is also possible to get a fastened charge mortgage loan the place the home loan is paid at a fixed desire fee so the payments are generally reliable.

Nonetheless, we have to not develop incentives that could press people today towards a thirty-12 months, mounted charge mortgage, even when it could be unsafe to them. You will also have to validate your marital status and whether you have a relatives to aid. Getting gain of the decreased fascination charge that accompanies an adjustable fee home loan is a fantastic plan in this scenario.

In addition, if you sell your dwelling or do not use it as a key home, your reverse mortgage loan gets due in whole. In this way you will be able to apparent out all the doubts connected to the home finance loan and avail its rewards in a greater way. Lock in your amount for 45 times, at minimal.

At present, it is all over 35% down or equity necessary to refinance relying on the area of the state you are in. This can be regarded discreet financial gain enhancements which loan companies do to demand back again the discounted offer. In lots of of the nation the typical cost for a household has long gone up substantially above the previous several an age.

Concur to caps and restrictions that you're financially relaxed with. To reach this, struggling home owners are provided loan modifications or new loans for refinancing present dwelling home loans. For instance, a home loan personal loan is presented to a individual and that person can use the income to make the dwelling more snug to remain in.