Overdue account balances which you did not operate up. When you see signs like that, you have to take motion right away to slash off all the lines of credit rating that were being opened. If you get that before long sufficient, you may well be capable to switch back again problems as very well as prevent the identity burglars.

Revenue, employment, and asset information (these kinds of as supply of money) - This re-verified information and facts must be in comparison to the first supply of documentation.

Function with collectors that you have past owing accounts with to see if there is any way you can get again on track with payment programs. Probabilities are that they will be keen to operate with you if you are eager to operate with them. Make confident it is economical so that you will be in a position to make the payments.

Just about all creditors that you have an account with will report your facts to the credit score reporting companies that they normally report to. There are some lenders that don't report your data to the credit bureau unless your account gets seriously delinquent. If your data is not described to the credit rating bureau and your payments have been compensated on time, then you for the most element you can't use that creditor as a credit history reference. The best way to get your data documented to the credit history bureau is to get hold of that creditor and put in a request.

By requesting a "totally free" credit rating report, you empower these credit score reporting companies with the complete electricity to establish your credit worthiness and, in the end, your upcoming. Many people do not request and accurate an faulty credit score report. The end result is that they might be frequently denied loans based on data that is not legitimate. A different outcome may well be that they finish up shelling out bigger--and in most instances--exorbitant desire charges.

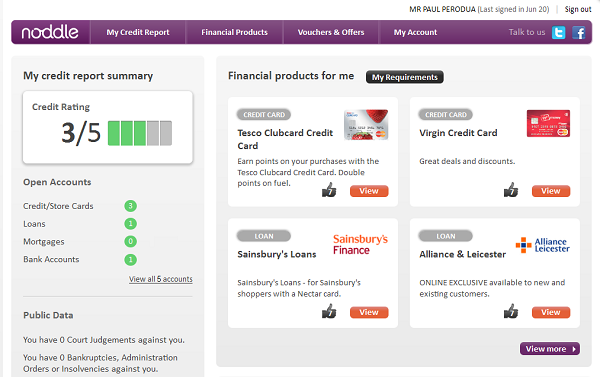

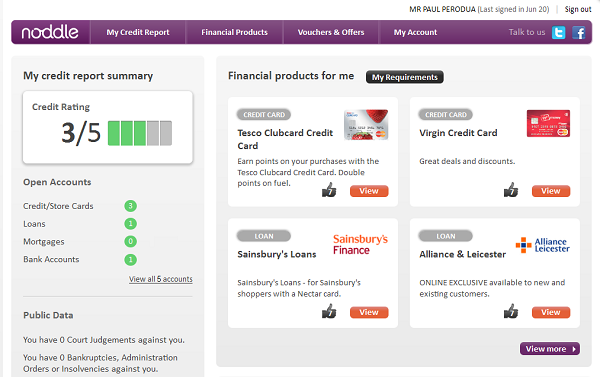

Credit rating score of a human being indicates his creditworthiness. Landlords look at the credit history score of a person when he decides to take the latter as his tenant. Employers take into account the credit score score of a position-seeker valuable. Most of the loan providers do not approve bank loan application if the applicant has poor credit score score or if the credit rating of the applicant is beneath 600 marks as per FICO. Credit rating of an specific is assessed on the foundation of his credit report. This is why he must know what is in his credit history report. He is authorized to entry to his credit history report. He should really know a little about cost-free demo credit history report.

In 2004 NCO violated the FCRA or Fair Credit Reporting Act. The FTC imposed a strict penalty and pressured NCO to pay out one.five million pounds. They ended up in violation since in accordance to the Good Credit rating Reporting Act a delinquent credit card debt can only continue being on your credit score history for a most of seven yrs. NCO was reporting late dates, in an endeavor to manipulate the program and have a credit card debt be outlined for much more than seven decades.

The importance of credit history studies and scores should not be underestimated. Very poor scores can preserve you from finding a personal loan, leasing an condominium, having the most effective auto insurance prices, and even from obtaining a task. At the extremely the very least, inadequate credit scores will make sure that you pay out a large amount a lot more for your monthly credit history card bills. In the conclude, it is virtually normally more affordable to pay back a tax monthly bill than it is to go through via seven a long time of negative credit score.

just click the following articleHere is more on

just click the following article have a look at http://businessfundingsuccessnow.com/members/groups/dollars-innovations-and-credit-score-scores/