When a business needs money, sometimes the lender asks for a person to guarantee the loan. This person is called a personal guarantor. Choosing this person is not easy. If the business cannot pay the loan, the guarantor must pay. So, this is a serious job. A funding partnership agency can help a business owner choose the right personal guarantor. They guide and support so the decision is not a mistake. It is important to choose with care.

Many people think a guarantor only needs a good credit score. But this is not true. A good guarantor also needs to be someone you trust. The agency helps you understand the role clearly. The guarantor is not just helping once. They are taking legal responsibility. If the business fails, the guarantor must pay. So, the decision should not be emotional. The agency brings experience. They check if the person is a good match for your business plan.

Sometimes the lender asks for a personal guarantor for corporate financing. This happens when the company is new or has little history. Some people ask friends or family to help, but this can bring problems later. A funding agency will help you look at this carefully. They check the credit, the risk, and how it will affect the funding. They also help with writing a good agreement. This paper will protect you and the guarantor too.

A problem can happen if the guarantor wants to leave later. Or if they cannot pay when something goes wrong. Without a clear paper or contract, there can be big issues. The agency helps make sure the agreement has strong and fair rules. This keeps both sides safe. It also makes the lender feel more confident. A good contract makes the relationship clear from the beginning.

There are also times when you need a personal guarantor for business loan. This may happen with a lease or equipment loan. These are not small. They can be big money. The agency helps you think before asking someone. Maybe it is better to try a small loan first. If it works, then go for a big one later. This step-by-step way is safer. It also builds trust with the guarantor.

Not all guarantors know what they are signing. They think the risk is low or short. But the truth is different. The agency helps explain things to the guarantor too. This is important. If the guarantor understands everything, there is less risk of future problems. Everyone needs to know what happens if the business pays late or fails. When all sides know the truth, they work better together.

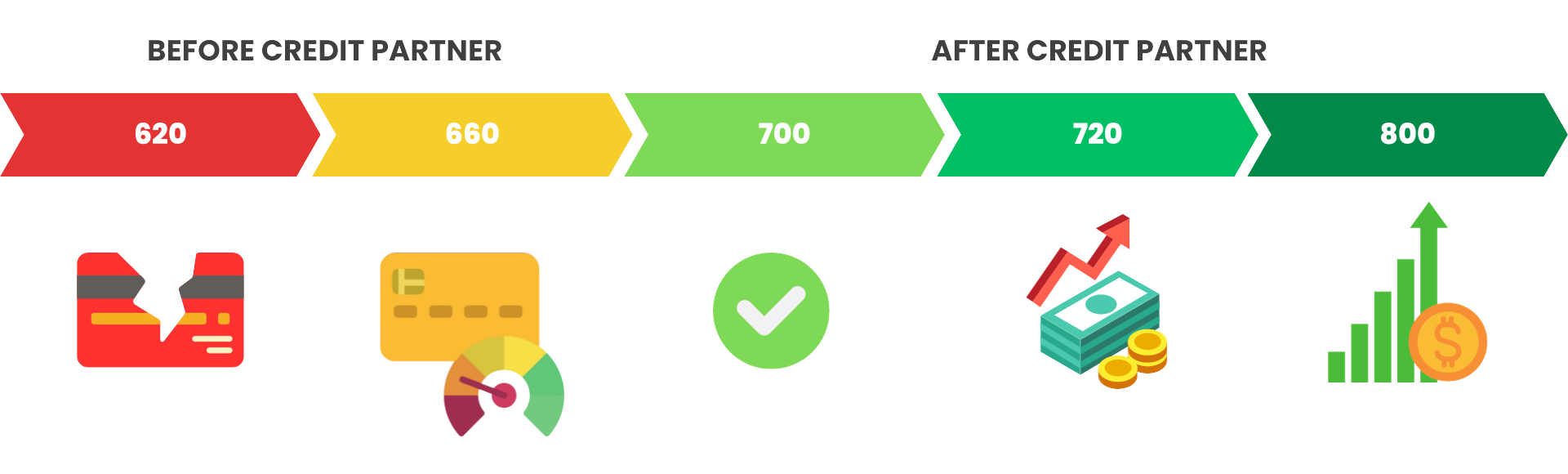

Also, the agency looks at the guarantor’s money situation. Maybe this person is helping someone else too. Or maybe their income is not stable. Even if they look good on paper, there can be hidden risks. The agency checks everything well. They also ask questions about the future. Will this person still be able to help next year? Will their credit stay good? These are not small questions. They are important for the business journey.